tax loss harvesting limit

Then you use that loss to reduce your taxable capital gains and potentially offset up to 3000 of your ordinary income. As a married couple filing jointly or a single filer you can realize up to 3000 of capital losses to reduce your ordinary taxable income in a given year.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

When you start investing you dont set.

. However Internal Revenue Service IRS rules allow additional losses to be. Tax loss harvesting cannot turn a loss into a gain but it can mitigate your losses by reducing your tax liability. Even better any remaining tax losses can be used to reduce your overall regular income taxes at a rate of up to 3000 each year until the losses are exhausted.

In this scenario you can use any remaining losses to offset up to 3000 of ordinary taxable income for the year. Investors are allowed to claim only a limited amount of losses on their taxes in a. Mary can use the 7000 capital loss to.

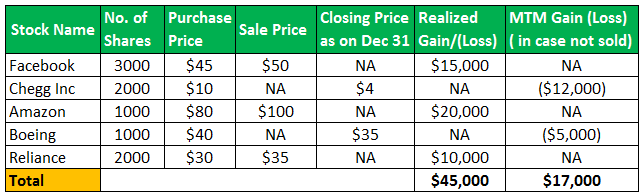

So if you have a 4000 gain and a 1000 loss you. To tax-loss harvest Mary would sell that fund thereby recognizing a 7000 capital loss. Currently the amount of excess losses you can claim as a deduction is the lesser of 3000 1500 if youre married and file separately or the total net loss that appears on line 21 of Schedule D on your tax return.

They can usually also offset up to 3000 in other income. According to the wash-sale rule when you harvest losses you cannot repurchase substantially identical investments for 30 days. Tax-loss harvesting is when you sell investments at a loss in order to reduce your tax liability.

Investors often harvest their investment losses near the end of the year. Once you have 50000 or more in your account you can sign up for its free tax-loss harvesting service. When to Implement Tax-Loss Harvesting.

Even if you cant claim the maximum 3000 net loss you can still reduce the value of your gains and save on taxes that way. And Mary would use the proceeds from the sale to purchase another fund to serve as a replacement in her portfolio. What is tax-loss harvesting.

You sell an investment thats underperforming and losing money. However there are limits to the amount of taxes on ordinary income that can be offset. In most cases the burden of tax-loss harvesting is too high for investors to do on their own.

The beauty of tax-loss harvesting is that you can use capital losses to offset all your capital gains. Some tax-loss harvesting limitations may include the limit on how many capital losses can be used in a year to offset capital gains for both short- and long-term losses. Generally those losses can then offset any capital gains from selling securities.

Whenever total capital gains and losses for the year add up to a negative number a net capital loss is incurred. Tax-loss harvesting is a complicated investing strategy that can help you reduce your tax burden and keep more money in your portfolio. Tax-loss harvesting can offer tax benefits but there are limitations on what you can deduct.

Tax-loss harvesting generally works like this. But you could sell off your investments at any time. Tax loss harvesting is an investing strategy that can turn a portion of your investment losses into tax offsets helping turn financial losses into wins.

Working with a robo. There is no limit to the amount of investment gains that can be offset with tax-loss harvesting. The upside of losing is limited to 1500 to 3000 a year.

Tax-loss harvesting limit. There is a 3000 limit on the amount of capital gains losses that a federal taxpayer can deduct in a single tax year. Waiting until the end of the year to consider tax-loss harvesting could be helpful if you want to use your losses to offset the gains that have accumulated throughout the year.

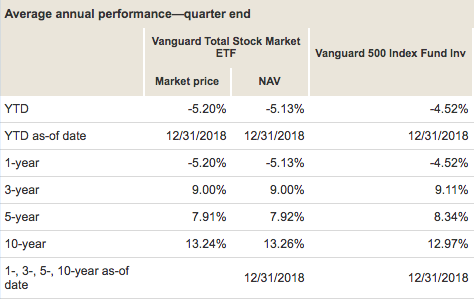

This illustrates that tax loss harvesting is more impactful for short-term gains but is still useful for long-term gains as well. Tax loss harvesting involves selling a losing investment in order to generate capital losses that you can write off on your tax return. If the net capital loss is less than or equal to 3000 1500 if you are married and filing a separate tax return then that entire capital loss can be used to offset other types of incomelike the income from your job.

You can harvest losses to offset gains as well as up to 3000 in non-investment income. Taxpayers can often use tax-loss harvesting to lower their tax burden by selling their investments at a loss. Even better if your capital losses are more than your gains you get a bonus tax benefit.

Even if you dont have any capital gains in a given year you can use up to 3000 in capital losses to lower your income tax. If your losses completely offset your gains then that leftover amount can be used to offset your taxable income. Online Assist add-on gets you on-demand tax help.

How tax-loss harvesting works. Use this also to find the ideal assets for gift giving or charitable donations. In the 24 tax bracket that would come out to 024 4000 960 paid in short term capital gains and 015 4000 600 in long term capital gains.

If she deployed the same tax loss harvesting strategy she would have reduced her capital gains tax liability from 300 to 75 a reduction of 60. This means that the IRS only allows up to 3000 of capital losses to be used each year to minimize the amount owed on income tax if your tax status is single or youre married and filing jointly. 2000 x 15 300 2000 - 1500 500 500 x 15 75.

Is there a limit to tax-loss harvesting. Limit capital gains for your clients Help your clients offset short-and long-term capital gains with automatic tax-loss harvesting of client accounts. Tax-loss harvesting offers the biggest benefit when you use it to reduce regular income since tax rates on income typically run higher than rates on long-term capital gains.

Identify appreciated lots for your clients Sell winning investments to realize gains for clients.

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Opportunity For Fiscal Year Fy 2021 22 Z Connect By Zerodha Z Connect By Zerodha

Tax Loss Harvesting Example Of Tax Loss Harvesting How Does It Work

Tax Loss Harvesting Definition Example How It Works

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Turning Losses Into Tax Advantages

Tax Loss Harvesting Definition Example How It Works

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Reap The Benefits Of Tax Loss Harvesting

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Everything You Should Know

Turning Losses Into Tax Advantages

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh